Understanding Difficult Cash Loaning: Provider Offered and Their Uses

Difficult cash providing offers as an essential choice for obtaining funding in genuine estate purchases. It focuses on residential or commercial property worth over borrower credit report, offering fast capital for numerous projects. This technique can be useful in specific situations, yet it likewise lugs fundamental threats. Comprehending the nuances of hard money loaning is necessary for possible debtors. What variables should one think about before seeking this choice? The answers might expose unexpected insights right into this one-of-a-kind financial landscape.

What Is Difficult Money Borrowing?

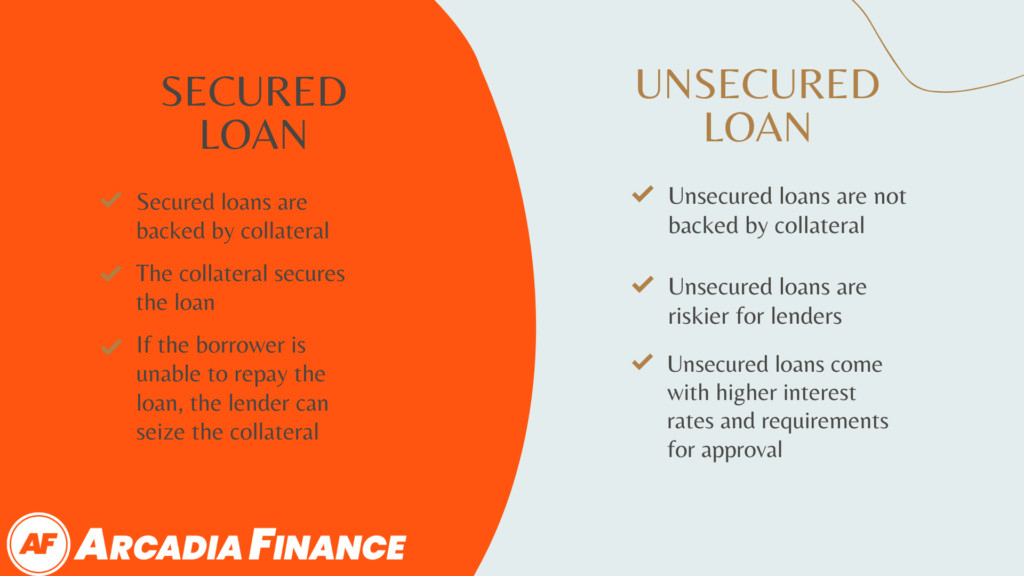

Hard cash offering refers to a kind of funding where lendings are secured by property as opposed to credit reliability. This financing option is normally offered by personal capitalists or firms, and it is commonly used in scenarios where standard lendings are difficult to acquire. The key emphasis in hard money borrowing is the residential property itself, which works as security. Consumers might look for hard money finances for various reasons, including quick access to funds for genuine estate financial investments, rehabilitation jobs, or to avoid repossession. As a result of the greater risk connected with these financings, rate of interest prices tend to be greater than those of conventional loans. The loan terms are usually much shorter, often ranging from a few months to a number of years. While difficult money lending can help with quick funding, consumers need to beware concerning the terms to prevent potential monetary pitfalls.

Sorts Of Hard Cash Loans

The landscape of tough cash providing includes various kinds of loans tailored to particular demands. Residential difficult cash finances cater to specific house owners, while commercial difficult money financings concentrate on service properties. Additionally, bridge financing alternatives offer short-term financing remedies genuine estate transactions.

Residential Hard Money Loans

While typical funding techniques might not suit every debtor, residential difficult cash finances use a choice for those seeking rapid funding genuine estate investments. These car loans are usually secured by the residential property itself instead than the debtor's credit reliability, making them easily accessible to people with less-than-perfect credit scores or urgent financing requirements. Residential tough money fundings are frequently utilized for investing in, refurbishing, or re-financing residential properties, especially by investor aiming to take advantage of market possibilities. With shorter terms and higher rate of interest, these car loans are developed for fast purchases and can often be refined within days, permitting borrowers to seize investment potential customers that might or else be unattainable with traditional lending networks.

Commercial Difficult Money Car Loans

Commercial tough cash financings work as a vital funding choice genuine estate capitalists and developers seeking fast resources for various commercial jobs. These loans are commonly safeguarded by the property itself, enabling loan providers to offer funding based on the property's value as opposed to the consumer's creditworthiness. They are frequently used for acquiring, refinancing, or renovating commercial properties such as office complex, retail areas, and industrial facilities. The authorization process is accelerated, making it possible for consumers to gain access to funds swiftly, which is ideal for time-sensitive deals. Although these lendings featured greater rate of interest and shorter settlement terms contrasted to traditional funding, they supply flexibility and speed, making them an important device for capitalists navigating open markets.

Bridge Loan Options

What options are offered for investors requiring immediate funding? Bridge funding works as a vital option, providing quick access to resources for genuine estate deals. This sort of tough money lending is commonly short-term, designed to connect the void in between an instant monetary demand and lasting financing. Financiers can utilize swing loans for different functions, including obtaining residential or commercial properties, moneying renovations, or covering functional costs during modifications. These financings often come with higher rate of interest and costs contrasted to typical financing, showing their expedited nature. In addition, swing loan can be secured against the residential property being funded or other assets. This adaptability makes them an eye-catching option for capitalists wanting to take advantage of time-sensitive chances in the realty market.

Trick Solutions Offered by Hard Cash Lenders

Difficult money lending institutions supply a series of important services that accommodate actual estate financiers and residential property programmers looking for fast financing options. One primary solution offered is short-term fundings, which are frequently used for purchasing or refurbishing buildings. These financings typically have a quicker approval procedure compared to typical funding alternatives, enabling investors to act quickly in affordable markets.Additionally, hard money lending institutions might supply construction finances tailored for jobs calling for substantial financing. This solution allows programmers to protect the necessary funding to finish building projects without substantial delays.Moreover, many difficult money lenders give versatile terms, suiting various situations such as fix-and-flip jobs or refinancing existing buildings. They likewise concentrate on the value of the home as opposed to the customer's creditworthiness, making it available for those with less-than-perfect credit score histories. These services jointly enable financiers to profit from possibilities successfully and properly in the realty market.

Benefits of Hard Money Borrowing

Hard money offering offers numerous advantages that attract consumers seeking instant financing. One crucial advantage is the fast accessibility to funding, allowing financiers to take opportunities without prolonged authorization procedures. In addition, the adaptable financing terms often accommodate distinct monetary situations, giving debtors with choices that typical lending institutions may not supply.

Quick Accessibility to Funding

Acquiring fast access to resources can be a game-changer for actual estate capitalists and entrepreneurs when time is of the essence. Hard cash lending offers a streamlined process that usually allows debtors to secure funds visit this website in days as opposed to months or weeks. This fast turn-around can be crucial when seizing time-sensitive possibilities, such as completing or acquiring distressed homes in an affordable market. Additionally, tough cash lending institutions generally require less documentation than traditional financial institutions, additionally accelerating the authorization procedure. The ability to swiftly get funds enables capitalists to act emphatically, boosting their potential for successful endeavors. Eventually, this quick accessibility to funding positions customers to profit from rewarding opportunities prior to they are shed to others in the marketplace.

Adaptable Car Loan Terms

For those seeking financial options customized to their details requirements, hard money providing deals a distinct benefit with its Read More Here adaptable loan terms. Unlike conventional finances, which typically feature inflexible settlement timetables and rigorous certification requirements, hard money loans can be customized to fit the debtor's distinct scenarios. Lenders may readjust rates of interest, funding period, and payment frameworks based upon the asset's worth and the consumer's monetary scenario. This adaptability permits debtors to handle their capital better, dealing with short-term jobs or financial investments. In addition, the rate of approval and funding assists customers seize time-sensitive chances, making difficult cash offering an enticing choice for those needing a much more tailored strategy to funding.

Scenarios Where Hard Cash Fundings Are Beneficial

In what scenarios might hard cash car loans confirm advantageous? These loans are especially useful genuine estate capitalists who need fast funding to take profitable opportunities, such as attending or acquiring troubled homes residential or commercial property public auctions. Standard loan providers may not offer the necessary speed or versatility, making hard cash financings an appealing alternative.Additionally, individuals with bad credit report might locate tough cash financings useful, as lending institutions mostly assess the value of the collateral rather than the consumer's creditworthiness. This makes it much easier for those who may deal with standard financing to safeguard funding.Furthermore, hard money fundings can be beneficial for temporary tasks, such as renovations or flips, permitting investors to maximize market trends rapidly. Finally, debtors needing to shut deals rapidly, why not try these out probably as a result of time-sensitive scenarios, usually transform to hard cash car loans for their expedited authorization procedure.

The Application Refine for Hard Money Loans

:max_bytes(150000):strip_icc()/unsecuredloan.asp-final-a5034e8ebf9d4622914bf0f208717774.png)

Dangers and Factors To Consider in Hard Cash Borrowing

While tough cash offering deals fast accessibility to capital, it additionally carries significant threats and considerations that debtors should meticulously review. One primary worry is the high rate of interest prices typically associated with these car loans, frequently varying from 7% to 15%, which can strain a borrower's economic resources. In addition, hard money financings normally have shorter terms, usually needing payment within one to 3 years, boosting the seriousness for effective project completion or refinancing.The dependence on property as collateral presents an additional threat; if the consumer defaults, they could lose their asset. Furthermore, the lack of regulative oversight can lead to predative loaning techniques, making it crucial for borrowers to completely investigate loan providers and understand funding terms. The unpredictability bordering home values might influence the borrower's capacity to settle, emphasizing the need for extensive financial preparation and risk assessment prior to proceeding with tough cash lending.

Often Asked Inquiries

Just How Do Rates Of Interest Contrast to Typical Financings?

Rates of interest for tough money fundings typically go beyond those of conventional financings, reflecting the higher danger and much shorter terms entailed. This disparity can considerably affect general loaning prices and repayment strategies for debtors looking for fast funding options.

Can Hard Cash Loans Be Made Use Of for Personal Costs?

Tough cash fundings are generally not meant for personal expenditures. Hard Money Lenders Atlanta. They are largely made use of for real estate financial investments, funding residential or commercial properties, or immediate capital requirements. Debtors ought to consider various other alternatives for individual financial needs

What Happens if I Default on a Tough Cash Car Loan?

The loan provider normally starts foreclosure procedures if a specific defaults on a hard money lending. This may result in the loss of the security residential or commercial property, influencing the consumer's debt and monetary security significantly.

Are Tough Money Lenders Controlled by the Federal government?

Tough money lenders commonly run outside standard banking laws. While some states enforce certain guidelines, total federal government oversight is restricted, enabling lenders significant latitude in their operations and financing terms, which can affect borrower safety.

Just How Promptly Can I Get Funds From a Difficult Cash Lending Institution?

The speed of fund disbursement from hard money loan providers varies, however borrowers frequently receive funds within days. This fast turn-around is because of the marginal documentation and structured processes commonly related to tough cash loaning. Residential difficult cash finances cater to individual homeowners, while business difficult money financings focus on company properties. Hard Money Lenders Atlanta. These car loans normally have a quicker approval procedure contrasted to traditional financing alternatives, making it possible for capitalists to act quickly in competitive markets.Additionally, difficult money loan providers may offer building and construction loans tailored for projects calling for considerable financing. Unlike traditional loans, which commonly come with inflexible payment timetables and strict certification standards, hard money car loans can be tailored to fit the customer's one-of-a-kind conditions. Typical lending institutions might not provide the required rate or versatility, making tough money finances an enticing alternative.Additionally, individuals with poor debt backgrounds might locate difficult money loans advantageous, as lending institutions mainly evaluate the value of the collateral instead than the debtor's creditworthiness. Interest prices for difficult cash lendings usually surpass those of conventional lendings, reflecting the greater danger and shorter terms included